Sector

Finance and Investment

Chemonics works with investors, financial institutions, governments, and development finance institutions to design and deliver tailored finance and investment solutions—from expanding financial product offerings and fintech innovations, to mobilizing capital through blended finance, to providing advisory services to strengthen investment and policy environments conducive to business and trade. We specialize in bridging the gap between finance providers and underserved populations in lower resource settings and highly stressed environments. As an investor ourselves, we have the knowledge, networks, and solutions to deliver returns in new markets.

Capital Mobilization

We design innovative instruments to maximize impact.

Collaborating with investors, businesses, and governments, Chemonics directs capital into high-impact sectors such as health, climate resilience, agriculture, water and infrastructure, and enterprise development. Chemonics provides technical advisory and project design services to structure public-private partnerships and blended finance tools that address capital gaps. We work to ensure capital reaches where it’s needed most—minimizing risk and optimizing returns.

Fintech and Digital Finance

We digitalize financial inclusion to accelerate growth.

At Chemonics, our fintech and digital finance solutions are designed to expand inclusive financial access and accelerate economic outcomes across emerging markets. Collaborating with commercial banks, fintech venture studios, startups, mobile network operators, central banks, and development financial institutions, Chemonics designs and implements innovative fintech solutions and provides advisory services to strengthen digital finance ecosystems.

Investment and Policy Advisory

We facilitate investment flows in emerging markets.

Chemonics delivers a comprehensive suite of investment advisory services to unlock private capital and drive sustainable development in emerging markets. Our investment advisory services span investor journey mapping, pipeline development, and transaction facilitation. We broker strategic partnerships that connect local enterprises with global capital flows. Chemonics also works alongside government clients to develop investment enabling policies and investment attraction strategies.

Financial Product Development

We help finance providers to reach new clients.

Chemonics develops innovative financial products—such as concessional debt, guarantees, sector- and segment-tailored instruments, and seed and innovation funds—to mobilize private capital for development and expand market-driven, inclusive access to finance. We back these offerings through direct support to finance providers to identify opportunities for efficiency, cost savings, or improved access to customer due diligence data. We provide advisory services on structuring, market testing, and risk mitigation to ensure products are viable and scalable.

Impact in Numbers

Case Studies

Case Study

Mobilizing Investment for Inclusive Growth in Uganda

Case Study

Expanding Rural Financing in Colombia

Case Study

Expanding Access to Finance for Tourism Enterprises in Jordan

Case Study

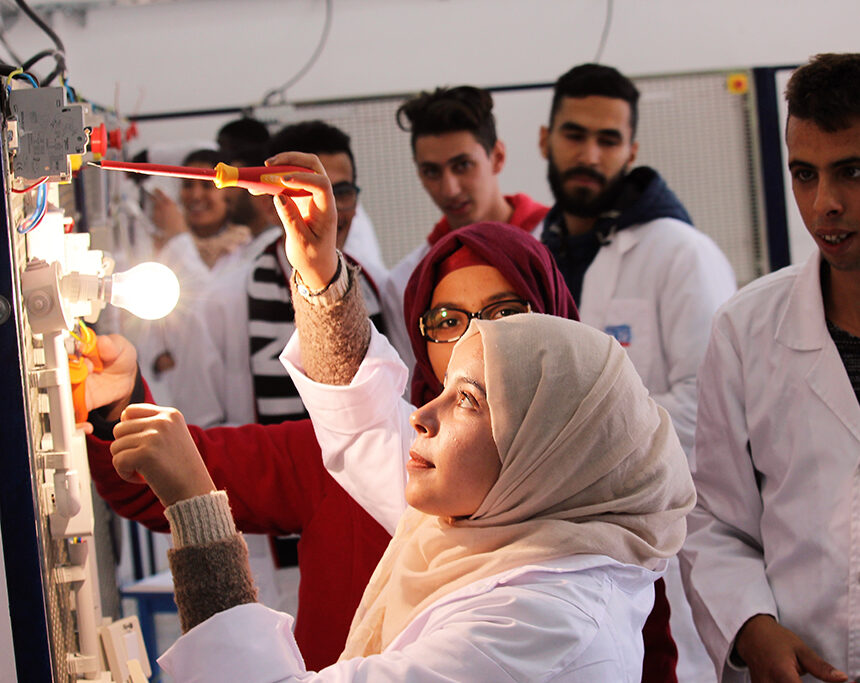

Generating Job Opportunities through Finance and Investment in Tunisia

Featured Experts

Our Partners

Interested in Chemonics' finance and investment services?

Contact Us

Connect with us and learn more about Chemonics’ finance and investment services