Case Study

Catalyzing Capital Across the Caribbean

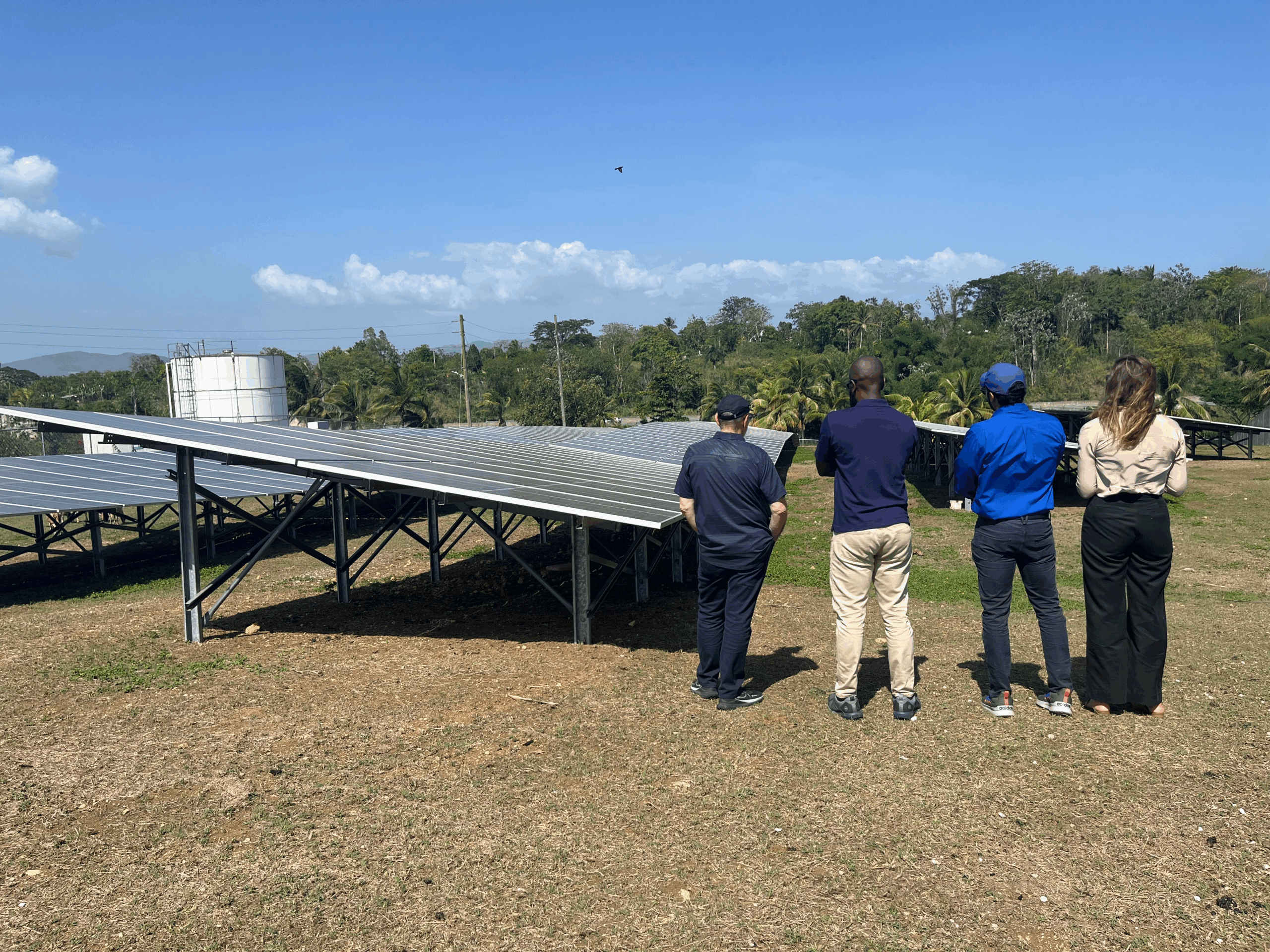

Equipping climate entrepreneurs with the tools to drive the energy transition.

Climate Finance

The Challenge

The Caribbean region is highly vulnerable to climate change due to a combination of geographic, economic, and environmental factors. While committed to mitigating greenhouse gas emissions, resiliency, and transitioning to distributed energy generation, the region lacks private investment in non-utility-scale projects and ventures led by small- and medium-sized enterprises. This is particularly true for firms operating in the commercial, industrial, and service sectors. Despite regional demand for project finance, investors often perceive it as too risky, leaving entrepreneurs trapped in the pre-investment cycle without the capital they need to grow and scale.Our Solution

Unlocking private sector investments to increase resilience.

Chemonics stood up the Caribbean Climate Investment Program (CCIP) to increase resilience across 14 countries by unlocking private sector investments in distributed energy and energy efficiency technologies. CCIP integrated three typically independent mechanisms – a project preparation facility, grants, and on-demand technical assistance to create an ecosystem of services to support climate impact entrepreneurs in accessing investments. Specifically, the blended program worked on:

- Pipeline Development: Identifying and nurturing a portfolio of bankable projects with strong climate adaptation or mitigation potential.

- Advisory Services: Offering technical guidance to ensure projects meet the standards required by investors.

- Investment Facilitation: Helping projects reach financial close by supporting deal structuring and matchmaking with funders.

The Impact:

Closing Deals. Opening Doors.

We equipped entrepreneurs and financiers in the Caribbean to more effectively close deals that increase the region’s economic growth, energy transition, and resilience to natural disasters. The impact by the numbers is significant:

- $48.2 million deals reaching financial close.

- $5.2 million in funds leveraged for the grant program.

- More than 60 projects serviced to unlocked $300 million in capital needs.

- More than 250 financial institutions, investors/funds, entrepreneurs, and national and regional organizations participating in a climate impact network.